The Canada Emergency Business Account (CEBA) loan was provided to eligible Canadian businesses in response to the economic challenges posed by the Covid-19 pandemic. The loan terms allow recipients to receive up to $20,000 of the loan amount as “forgiven” if repayment is completed by December 31, 2023 (extended to January 18, 2024).

Some business owners are currently repaying their CEBA loans to ensure they receive the forgiveness amounts.

Our advice: AVOID REPAYING TOO EARLY if your business is actively using the loan to maintain cash flow for operations. Why? There’s a petition circulating to urge the government to extend the repayment deadline and facilitate forgiveness. If this request is granted, you can benefit from a potential extension if you still have an outstanding amount.

Instead, we recommend the following:

- Check the CEBA status by mid-December for any possible extensions (bookmark this page – we will update this page if an extension is announced).

- Prepare to repay the loan by

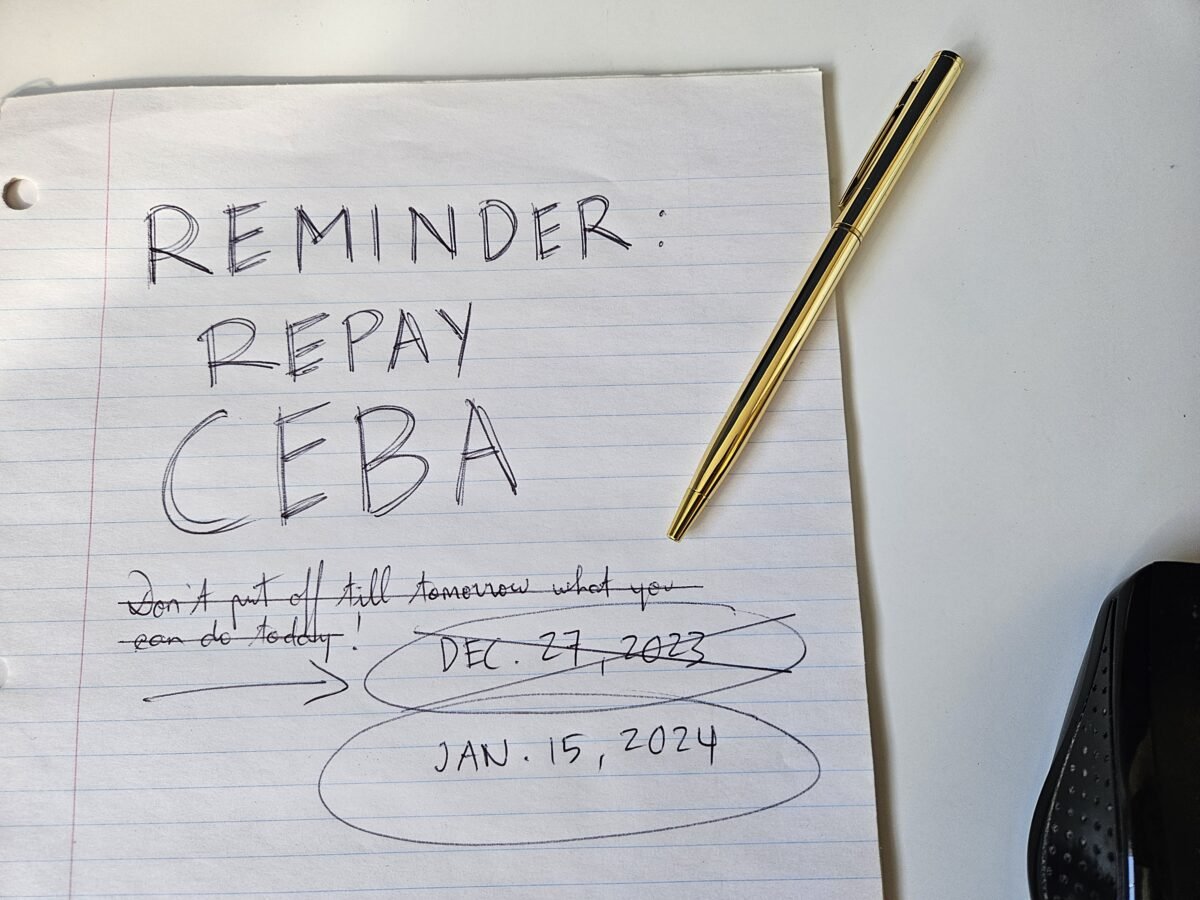

Wednesday, December 27, 2023Monday, January 15, 2024, to ensure that transactions are posted in a timely manner. Consult your financial institution for payment instructions. - If you’re concerned that the funds might be spent if left in your bank account, consider transferring them to a separate chequing or savings account until then.

- If you lack the means to repay the CEBA loan in order to obtain the forgiveness amount, what steps should you take? Our upcoming blog post will address this question. Follow us on LinkedIn to get an update.

About Reconcile: We offer a “financial health check” at no cost to you. We ensure that your financial position is reconciled, that government accounts are in order, and, most importantly, that you are aware of your financial standing. With our care and competence, you can determine the best course of action moving forward. Schedule a call with us to initiate the process!